The UK’s climate is becoming warmer and wetter with every passing year and flooding is seemingly a constant on news channels these days. Awful images of homeowners up to their knees in flood water surrounded by their sodden possessions are commonplace, but they remain no less shocking.

As the country’s population grows and the need for housing rises, floodplains are being built upon at a greater rate than ever before, despite calls for developments in areas at risk of flooding to stop. The knock on effect is that more and more buyers are faced with the should-I-or-shouldn’t-I dilemma of buying property on a floodplain.

Today’s post aims to shed a little light on the subject.

What are floodplains?

In the most basic terms, floodplains are areas surrounding rivers and streams which can experience flooding when water levels rise. Generally speaking, floodplains are flat and stretch from the river bank to the outer edges of the valley through which the water flows.

Floodplains can be both wide and narrow, with some rivers seemingly free of them altogether. The meandering nature of a river or stream plays a part in the extent of the floodplains present. As the water flows through the river’s winds and turns, it erodes the facing bank, thus creating a floodplain.

Are floodplains safe to live on?

As we’ll see later on, floodplains fall under different categories here in the UK, so a lot will depend upon which zone the property in question sits. Some homeowners may happily live on a floodplain all their lives without issue, while others won’t be so fortunate.

Another variable to take into account is local flood defence systems and their impact on the risk of flooding. Much of London, including the Houses of Parliament and Whitehall, safely sits on Flood Zone 3 land thanks to the Thames Barrier. Unfortunately, other areas of the country are, perhaps unsurprisingly, not so well protected.

Does living on a floodplain affect home insurance?

Most definitely, and in some instances the increase in premium can be significant. That being said, properties deemed to be high risk by insurance companies will often hit the market below the value of similar properties situated elsewhere, so it’s up to you to weigh up whether or not you’ll eventually end up paying more over the course of your ownership.

As with every other insurance premium, shopping around can have a dramatic impact on what you pay each year. Properties that have actually flooded in the past will obviously incur higher premiums than those deemed at risk but have never experienced a problem. Providing as much information as you can when buying home insurance for flood risk properties is vital if you want to obtain the best deal possible.

If you feel you are being quoted highly, or are being told the property is deemed uninsurable due to its previous record, you should check out FloodRe. This joint initiative between the Government and insurers aims to ‘make the flood cover part of household insurance policies more affordable’.

How to check a property’s flood risk

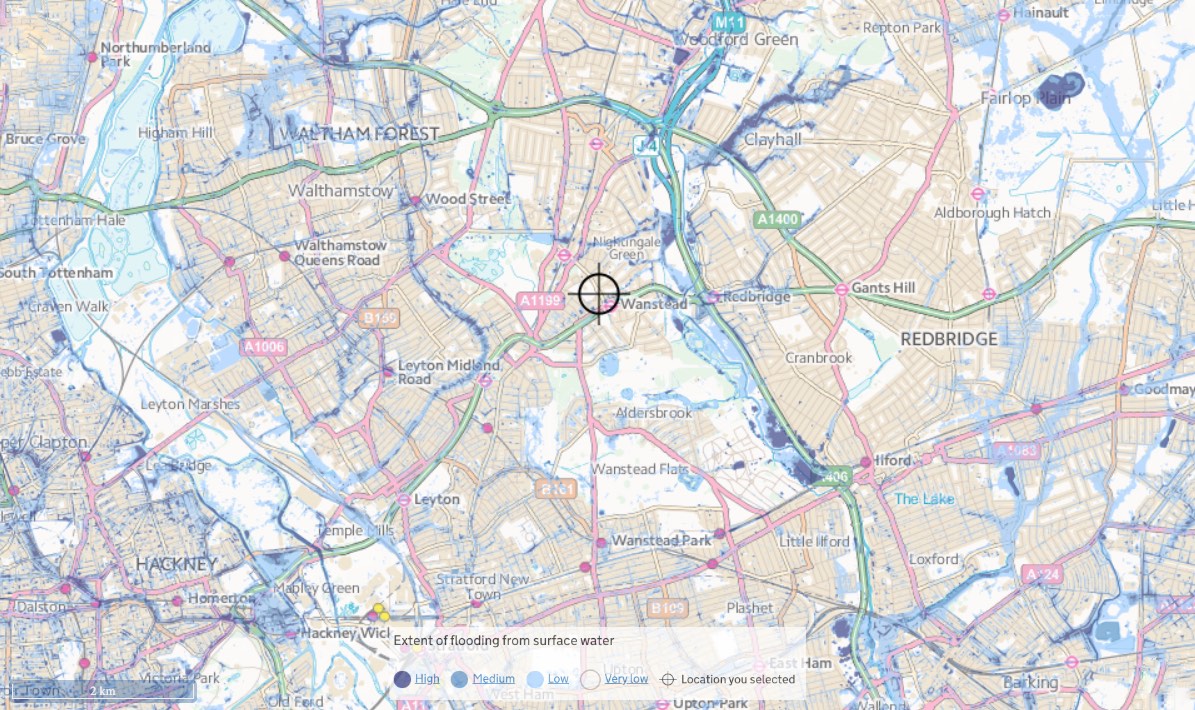

Checking an area's flood risk is as simple as entering the postcode of the home you’d like details of into this gov.uk flood page. As the page states, this will give you an overview of the area, not a property specific result, but it’ll give you a good idea of which zone it falls into.

Here’s what the page returned when we entered in the postcode for our Wanstead office:

Image courtesy of GOV.UK made available under the Open Government Licence v3.0. Image drawn from page: https://flood-warning-information.service.gov.uk/long-term-flood-risk/postcode

As the law currently states that risk of flooding is not required in surveys, the burden of responsibility lies with the buyer. It is, therefore, prudent to run your own checks prior to purchase, especially if the home in question sits near a significant stretch of water.

From a sellers point of view, it should always be made clear to prospective purchasers if the property has experienced flooding in the past. While it may be tempting to be economical with the truth, it’s morally reprehensible to do so. As we’ll see later on, you’ll likely get found out, too.

What do the different UK Flood Zone categories mean?

There are three Flood Zones in the UK defined by the Environment Agency. These are as follows:

Flood Zone 1

Areas designated Flood Zone 1 status are deemed to have a low probability of flooding (less than 1 in 1,000 annual probability of river or sea flooding).

Flood Zone 2

Areas designated Flood Zone 2 status are deemed to have a medium probability of flooding (1 in 100 and 1 in 1,000 annual probability of river flooding; or land having between a 1 in 200 and 1 in 1,000 annual probability of sea flooding).

Flood Zone 3a

Areas designated Flood Zone 3a status are deemed to have a high probability of flooding (Land having a 1 in 100 or greater annual probability of river flooding; or Land having a 1 in 200 or greater annual probability of sea flooding).

Flood Zone 3b

Areas given a Flood Zone 3b status are known as The Functional Floodplain. According to the EA’s website:

This zone comprises land where water has to flow or be stored in times of flood. Local planning authorities should identify in their Strategic Flood Risk Assessments areas of functional floodplain and its boundaries accordingly, in agreement with the Environment Agency.

Should you avoid properties on floodplains?

This really is one of those questions only the individual can answer. While some will recoil at the thought of even a remote possibility of flooding, others will see the opportunity of living close to water as a risk well worth taking.

If you are willing to do your homework and are fully aware of the risks involved, there’s no reason not to buy a home built on a floodplain. You do, however, need to do your research and possibly put preventative measures in place. Check out the National Flood Forum’s page on protecting your property for more details.

It’s also important to remember that you’re not alone. In fact, many UK homeowners live with the risk of flooding, and the majority do so without ever experiencing anything like the horrific images that make the news.

In short, then, properties sitting floodplains should be closely scrutinized, but definitely not rejected out of hand.

What about when you want to move on?

Before we go, you might be wondering what the implications are when you want to move on.

Well, to start with, if you bought the property, then it’s fair to say that someone, somewhere will be willing to do the same. Will it be a trickier sale than a home on high ground? Probably, but as you have already proved, that doesn’t make it impossible.

In terms of what you have to disclose to buyers, the legal standing on this is that you don’t have to tell them anything. However, in reality, there’s absolutely no chance of getting away with not disclosing historic flooding, thanks to the Seller’s Property Information Form, or SPIF for short.

Within this document you’ll find a question directly relating to historic flooding. Lying on this form is obviously a no-no and leaving the question unanswered will raise the conveyancer’s eyebrow, which means you’re likely to get found out either way...so, be honest! After all, you’d expect the same if the shoe were on the other foot, wouldn’t you?

Besides, despite the law not explicitly stating that you have to disclose historic flooding, if you did decide to withhold information, an environmental search report ordered by the buyer’s solicitor would likely pick up the risk anyway. Then there’s also a distinct possibility of being sued in the future, which is obviously to be avoided.

To summarise...do the right thing. Provide your buyer with as much information as possible.

If you found this post helpful and love reading about all things property, please do feel free to subscribe to our blog to get each week’s post sent directly to your inbox. We’re on social, too, so head over to Instagram, Facebook, Twitter, and Pinterest and give us a follow and a thumbs up 👍🏻