The question of who pays Council Tax on a rented property is not as straightforward as one might first assume and answers can often be misleading. Ask two friends who are currently renting, or have been tenants in the past, and you could easily receive two different responses.

Why would that be the case? Surely, either the tenant pays the Council Tax or it’s the landlord’s responsibility, it can’t be both...can it? In today’s post, we’ll find out.

What is Council Tax anyway?

Council Tax is basically a local tax, set by the relevant authority, which is graded by domestic properties and their value. Introduced back in 1993, Council Tax replaced the much-maligned Community Charge, aka Poll Tax, and has been in place ever since.

From a governmental point of view, Council Tax has been a roaring success. Back in 2014/15, Council Tax was said to cover almost a quarter of all local authority expenditure and it had an extraordinarily high collection rate of 97% across the same period, meaning that almost everyone pays up.

How is Council Tax calculated?

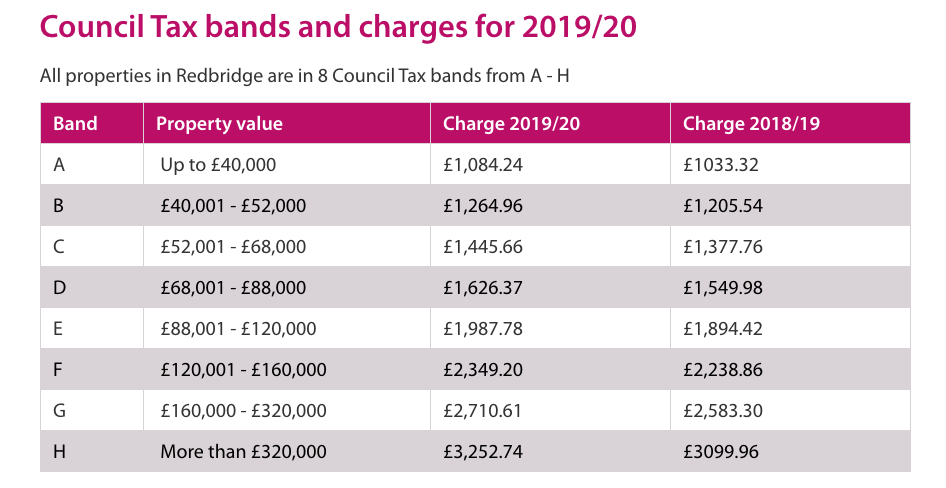

As touched upon above, Council Tax is actually a charge on residential properties which are separated into different bands, A to H. Each band covers a price range into which individual properties will fall and the charge is calculated accordingly.

Somewhat confusingly, these bands are based on the price each property would have sold for back in April 1991 and the bands are worked out by the HM Revenue and Customs Valuation Office.

However, different local authorities have their own individual pricing policies for each band, which makes giving a one-size-fits-all answer an impossibility. Below is the current table for Redbridge Council:

(correct at the time of writing, click here for the most up to date charges)

For those of you outside of Redbridge, there’s a great resource for finding out your Council Tax charges called My Council Tax

Who pays Council Tax?

While Council Tax is payable on all domestic properties across England and Wales, the question of who foots the bill is a thorny one. On a basic level, Council Tax is paid by the occupant, which is straightforward enough, but in some instances this isn’t the case.

For starters, there’s the issue of whether you are the sole occupier or if you live with others. If you live alone, it’s simple: you pay the Council Tax. However, for those who live with others, there’s a hierarchy that needs to be addressed, which looks like this:

- A resident owner-occupier who owns either the leasehold or freehold of all or part of the property

- A resident tenant

- A resident who lives in the property and who is a licensee. This means that they are not a tenant, but have permission to stay there

- Any resident living in the property, for example, a squatter

- An owner of the property where no one is resident.

As a hierarchy, you obviously work your way from top to bottom, so whoever is highest on the table above foots the Council Tax bill. If there are equal numbers of residents on the same level, liability is shared equally.

So, who pays Council Tax when renting, landlord or tenant?

As you can see from the Council Tax hierarchy tree above, a resident tenant comes in at number 2. This means that in the majority of cases, the tenant pays the Council Tax bill.

The majority, but not always...

When is the landlord responsible for paying Council Tax?

There are some instances where the landlord will shoulder the responsibility of paying Council Tax. These are special circumstances and, generally speaking, the only times when liability is reversed.

So, tenants who find themselves fitting into any of the following categories may exempt from paying Council Tax:

- The occupant or occupants are all under the age of 18

- The property in question is a care home, hospital, or refuge

- The occupant or occupants are asylum seekers

- Temporary rentals to cover instances where your main residence is having emergency work carried out on it

- The property in question is a HMO (House of Multiple Occupancy) and all occupants pay rent individually. However, while the landlord is technically responsible for paying Council Tax, it’s highly likely that the rent will be adjusted to cover the cost in this instance

What happens if you can’t pay your Council Tax?

As we mentioned early on in this post, Council Tax collection rates are one of the highest of all taxes. Therefore, if you find yourself in a position where paying Council Tax has become difficult, you need to address the situation sooner rather than later.

Your first call should be to your local authority to explain your situation and ask for help. Local councils have powers to recover any debts incurred by occupants who fail to make the necessary payments, so they need to be put in the picture as soon as possible.

If you are in financial difficulty, it’s also wise to consult with experts on the matter quickly. While it may be human nature to shy away from difficult conversations such as these, burying your head in the sand ultimately solves nothing, so please do make the effort to speak with someone as soon as you feel ready to do so.

Here are a few great places to start:

Are there Council Tax discounts available?

Yes, there are, but these are only available in relation to how many adult occupants there are living in the property. Again, the question over who is an adult and who isn’t is not as straightforward as it would appear, as some individuals fall into a category called ‘disregarded people’.

According to entitledto.co.uk, all of the following are considered such:

- anyone aged 17 or under

- living in the property temporarily and who have their home somewhere else

- prisoners

- in detention prior to deportation or under mental health legislation

- defined as a severely mentally impaired person

- full-time students on a qualifying course of education

- a spouse or a dependant of a student and a non British Citizen who is not allowed under immigration rules, either to work in the UK or claim benefit

- hospital patients who live in hospital

- young people on government training schemes, apprentices, or foreign language assistants

- living in a residential care home, nursing home, or mental nursing home where they receive care or treatment

- living in a hostel which provides care or treatment because of a person’s old age, physical or mental disability, past or present alcohol or drug dependence or past or present mental illness and in England and Wales a bail or probation hostel

- care workers

- carers

- staying in a hostel or night shelter, for example, in a Salvation Army or Church Army hostel

- school or college leavers still aged under 20 who have left school or college after 30 April. They will be disregarded until 1 November of the same year whether or not they take up employment

- aged 18 and someone is entitled to child benefit for them. This includes a school or college leaver in remunerative work, or a person in local authority care

- members of visiting armed forces and their dependants

- members of a religious community

Council Tax is calculated based on two adults living together in the same property, so there are discounts available for those who do not meet this criteria, such as:

- If you live alone, or are the only adult occupant, you will be eligible for a 25% discount

- If you are not counted as an adult, a 50% discount will typically be applied

- Full-time students will be eligible for 100% discounts providing they are the only occupants in the property

As with all matters of this nature, this post is provided as a guide for research purposes and should not be considered legal advice. Please consult a certified legal professional before taking any legal action.