Investing in property is a great way to build wealth and financial security for the future, but it’s not without its pitfalls. As with most things in life, though, a little knowledge goes a long way, and being aware of just a few simples rules can put you ahead of the vast majority of property investors.

Obviously, there’s more to a successful property investment than following a few simple dos and don’ts, but it’s amazing just how many prospective investors ignore the basics...and it’s often these fundamentals, when neglected, that come back to bite them.

So, with this in mind, we’ve put together 11 dos and don’ts all property investors should consider before they dive headlong into property investing.

Let’s start off with the dos!

DO:

Get your personal finances sorted first

Thanks largely to the way it has been portrayed in the media, countless people have looked to property investment as a way out of their own current financial hole. Big mistake.

While investing in property is indeed one of the finest ways to safeguard your financial future, you must already have a solid base to work from if you want to get ahead in the investment game.

It is not, however, a silver bullet that will end all of your past pecuniary peccadillos, so you’ll need to get your, ahem, house in order first.

Make a plan

If your personal finances are in reasonable shape, then the next thing you’ll need to do is make a plan. This doesn’t have to be as formal as, say, a business plan (you may even keep it to yourself, never to be seen by another’s eyes), but you do need to get a few things down on paper before you even begin looking at potential property purchases.

Think about things like your budget, how risk averse you are, what you want from your investment, where you see yourself in five, 10, even 25 years time, and what area of property investment you’d like to get into. Will being a landlord suit you or would you be better suited to buying fixer uppers, for example.

Another vitally important factor to plan for is time, which brings us nicely to...

Be realistic with timeframes

It’s important to remember that property works in a very different way to other investment markets and that you need to adjust your expectations accordingly, especially when it comes to timeframes.

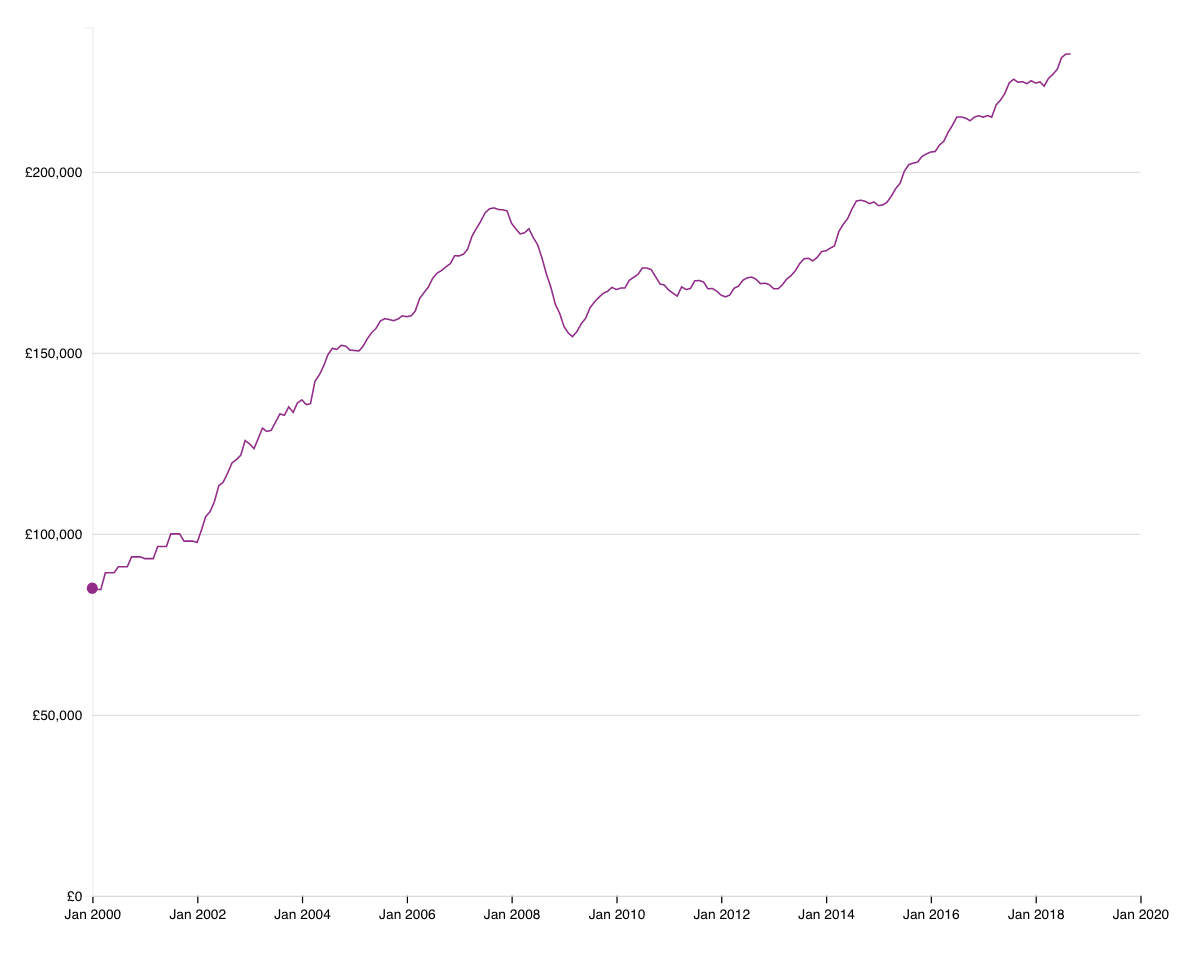

Investing in property is great if you’re in it for the long haul, but for short-term investors, not so much. Property is steady, so be prepared to ride out dips and even crashes. For the most part, property since 2007 credit crunch has performed admirably across the country, but plenty of investors sold up in March 2009 (when the market hit rock bottom) only to see continued growth from then on in.

So, the moral of this story is - be patient. Plan accordingly when starting out and be realistic with any timeframes you may set. Oh, and don’t panic over corrections. The UK property market is a hardy beast that invariably recovers from even the mightiest blows.

Your homework

Failing to study your investment is probably one of the biggest avoidable mistakes you can make and, in what is widely regarded as the Information Age, it’s unforgivable. Make sure you know all there is to know about your investment BEFORE you make it.

Read books on the investment type, study the wider property market, drill down on the local area and property type. Basically, find out all that you can while it is cheap to do so. Waiting until you’re already involved can prove to be a very costly mistake indeed.

One word of caution here, though. Be aware of your own capacity for analysis paralysis. If you’re stuck studying for years on end without taking action, then maybe you’re being overly cautious or your nature simply isn’t suited to investing. That’s okay, but you do need to be honest with yourself in order to move on.

Ask questions and seek advice

What you can’t find out, you can ask...and you shouldn’t be afraid to do so. Seek out experts and ask for their advice. Most will be thrilled to be seen in that light and only too happy to help; they all started somewhere, after all.

Remember: There are no silly questions, only silly mistakes, so get out there and ask away.

Use only fully-accredited agents

Despite the risk of incurring some rolling eyes, we had to finish our list of ‘Dos’ with this - beware the shady agent that promises the earth. Always, always, always check that the letting agent you choose to deal with has the necessary credentials and accreditation behind them before instructing them to handle your investment. It’s of paramount importance.

Here at Petty’s, we are fully accredited and backed by all of the industry’s leading governing bodies. When looking for an agent, keep an eye out for ARLA Propertymark accreditation and insurance backing that will cover CMP (Client Money Protection) and professional indemnity at a minimum.

DON’T:

Be hasty

Ever been offered something that’s too good to be true and fell for it? Feels rotten, doesn’t it? Now imagine that happening with a purchase as large as property…

Jumping in too fast has been the undoing of many an investor, so don’t do it. Take a deep breath and think before you act; it could save you a lot of time and money if you do.

Obviously, if after conducting the necessary due diligence all seems well, go for it. We don’t want you to miss out on an opportunity of a lifetime because of dilly-dallying, but you do need to think clearly and thoroughly before you act in this arena.

Keep in mind the fact that other opportunities will arise, too. Sometimes it’s simply better to wait it out.

Buy without viewing

As obvious as it sounds, it still happens. Some people (largely those who don’t heed the advice given above) still buy investment property without ever setting foot inside it. Bonkers.

The numbers who will indulge in such madness are thankfully few, but those who’ll buy in an unknown area are terrifyingly large. As mentioned in our list of ‘Dos”, make sure you do your homework, and that means getting out there to view the property AND the local area.

Forget about the bottom line

It’s important to remember your investment is all about the bottom line; nothing more, nothing less. Failing to recognise this is a sure path to losing money.

Take into account everything before you invest. Look at the OVERALL cost, not just the purchase price, and take into consideration any overheads you may incur along the way. Remember, this is a business, so run it like one.

Cut corners

We’re all for keeping costs as low as possible, but cutting corners should never be part of the property investor’s arsenal.

If you think furnishing a rental poorly, failing to perform the necessary checks, going without an inventory, or any other cost-cutting connivance will save you money, you’ll probably end up paying for it in the long term. Don’t do it.

Be cheap

On a similar theme, being cheap in other ways can cost you dear as well. This time around we’re talking about asking prices and how they can stymie many investors’ progress.

When presented with two properties, one selling for £150,000 and the other for £500,000, many will consider the first property to be the better investment, based on nothing more than the fact that it costs less than the second property. Naturally, this is no way to enter into an investment, but you’d be surprised at the amount of people who operate in this manner.

Again, this will fall into the category of doing your homework, but it’s still something that can be overlooked even after conducting due diligence if it’s in your nature. Be aware of it and go with the numbers in this instance, not your gut.

There you go, 11 dos and don’ts that will help any property investor make a better fist of their foray into property investing. As mentioned above, asking questions is one of the most important things you can do if you want to be successful, and we’re here to help!

If you’re thinking of investing property around Wanstead and its surrounding areas, give us a call. We’d be delighted to answer any questions you may have.